A couple users have inquired about why the emailed report is not sorted by date. However, upon closer examination, you'll see it is sorted by date...but within each business/vehicle.

When we were designing the report, we had to choose between listing all the trips by date, regardless of business, and listing the trips by business/vehicle. Since each business, and vehicle within a business, needs to be submitted separately to the IRS or to an employer, we opted for grouping the trips by business, then vehicle, sorted by date within a business/vehicle.

So if you look closely, you should see that all the trips for one business are together in chronological order, followed by the trips for the next business, and so forth. If multiple vehicles were used in one business, then the trips are sorted by vehicle first then date.

Wednesday, December 31, 2008

Monday, December 15, 2008

New IRS Rates: Effective January 1, 2009

The IRS has issued its new tax deduction rates for 2009. Come January 1st, please email yourselves a full report of your 2008 trips, and then clean out the Trips List. Then change the rates for your businesses/charities/medical/other categories to the following:

Business: $.55/mile

Charity: $.14/mile

Medical: $.24/mile

Business: $.55/mile

Charity: $.14/mile

Medical: $.24/mile

Tuesday, October 28, 2008

MileBug Story Hits DIGG Front Page!

TheAppleBlog ran a story last night entitled, "9 iPhone Apps for Your Car" that included links to reviews for each app listed. MileBug was among those 9 apps and the story hit the DIGG Front Page for Technology just before midnight! It's still there this morning with 415 diggs. In the MileBug review, he said, "The trip log that I liked best is MileBug from Izatt International."

Very Exciting! Spread the news!

Very Exciting! Spread the news!

Friday, October 24, 2008

U.S. IRS tax deduction rates

July-Dec. 2008

------------------

Business: $0.585/mile

Charity: $0.14/mile

Medical: $0.27/mile

------------------

Business: $0.585/mile

Charity: $0.14/mile

Medical: $0.27/mile

Thursday, October 23, 2008

Using Kilometers: Accessing your iPhone Settings

Basically, Apple has designated the iPhone/iPod Touch General Settings as the place to make "set once" choices that affect the behavior of an application. This is where the kilometers/miles setting can be found.

On the home screen, there is an icon labeled "Settings" that is gray and looks like a gear. Open "Settings" and scroll to the bottom of the screen. There you will see a selection for each application you have installed that has "set once" choices. MileBug will be listed, and by selecting it, you will find the following options:

1) Open To: (Trips List or Add Trip)

2) Measurement: (Kilometers or Miles)

So to use kilometers, simply select kilometers for the Measurement setting and return to MileBug.

On the home screen, there is an icon labeled "Settings" that is gray and looks like a gear. Open "Settings" and scroll to the bottom of the screen. There you will see a selection for each application you have installed that has "set once" choices. MileBug will be listed, and by selecting it, you will find the following options:

1) Open To: (Trips List or Add Trip)

2) Measurement: (Kilometers or Miles)

So to use kilometers, simply select kilometers for the Measurement setting and return to MileBug.

Labels:

international,

iPhone,

kilometers,

km,

milebug,

milebug update

$ Amounts Don't Show after Update!

No, you're not doing anything wrong. The data model changed in the update so you just need to reset your Type/Rate for each of your businesses. Here's what you do:

1) Change the rate on the business/charity/etc Type/Rate to something else and save it. Click "Change" if prompted.

2) Create a new TypeRate with the rate set to .585 (or the rate you want), keeping the old Type/Rate at some other value. Save.

3) Go into Businesses and select the new Type/Rate for each of your businesses/charities/etc. Save.

That should do it!

1) Change the rate on the business/charity/etc Type/Rate to something else and save it. Click "Change" if prompted.

2) Create a new TypeRate with the rate set to .585 (or the rate you want), keeping the old Type/Rate at some other value. Save.

3) Go into Businesses and select the new Type/Rate for each of your businesses/charities/etc. Save.

That should do it!

Labels:

data model,

iPhone,

mileage log,

milebug update,

track miles

Monday, October 20, 2008

UPDATE: MileBug 1.1 Submitted to Apple!

As of Saturday afternoon, October 18th, MileBug 1.1 is in the queue under review! So only a few more days at the reduced price...and remember, updates are free!

WHAT'S NEW in 1.1?

• Option for kilometers vs miles (General Settings)

• Custom deduction rates

• Define multiple business rates (reimbursement vs. deduction)

• "Other" business category for percentage tax filers

• Foreign and other special characters supported in reports

• Notes included in reports

• SPANISH version

More updates coming with even more features!

WHAT'S NEW in 1.1?

• Option for kilometers vs miles (General Settings)

• Custom deduction rates

• Define multiple business rates (reimbursement vs. deduction)

• "Other" business category for percentage tax filers

• Foreign and other special characters supported in reports

• Notes included in reports

• SPANISH version

More updates coming with even more features!

Labels:

international,

iPhone,

milebug,

track miles,

update

Saturday, October 11, 2008

MileBug gets 5 Thumbs-Up!

Just got the word from iTouchGuy at www.ireviewiphoneapps.com that a new review of MileBug had been posted this morning: 5 Thumbs Up!! Obviously we're happy people are enjoying and loving MileBug. Check out the review and pass it along!

http://www.ireviewiphoneapps.com/index.php?s=milebug

http://www.ireviewiphoneapps.com/index.php?s=milebug

Labels:

business,

iPhone,

mileage tracker,

milebug,

review

Saturday, September 27, 2008

New App: Fingerspell now available!

For those of you interested in other languages, you'll be excited to know that Fingerspell is now available on the App Store! It's the latest app by Izatt International.

Fingerspell is designed to help you learn the American Sign Language alphabet. It has three modes: Reference, Flash Cards, and Word Play.

Reference provides all 26 signs on a single screen for quick reference, plus a tap on any one will zoom in to full screen. You can also turn on/off English letter labels, and flip between the full screen photos just like you do the photos in your albums!

Flash Cards plays all 26 photos in random order at the speed you specify. Each photo appears for a moment then the corresponding English letter appears.

Word Play lets you enter any word and have it signed back to you using the full-screen photos. You get to specify the speed!

Fingerspell makes finger spelling fun and easy! Enjoy it for only $1.99! Check out the details at www.aslfingerspell.com.

Fingerspell is designed to help you learn the American Sign Language alphabet. It has three modes: Reference, Flash Cards, and Word Play.

Reference provides all 26 signs on a single screen for quick reference, plus a tap on any one will zoom in to full screen. You can also turn on/off English letter labels, and flip between the full screen photos just like you do the photos in your albums!

Flash Cards plays all 26 photos in random order at the speed you specify. Each photo appears for a moment then the corresponding English letter appears.

Word Play lets you enter any word and have it signed back to you using the full-screen photos. You get to specify the speed!

Fingerspell makes finger spelling fun and easy! Enjoy it for only $1.99! Check out the details at www.aslfingerspell.com.

Labels:

american sign language,

asl,

finger spelling,

iPhone,

ipod touch

Tuesday, September 16, 2008

Syncing Mileage Data: Apple's Restrictions

iTouch Users from all over have had trouble with many different applications freezing up and having to be reinstalled. Apple has now (hopefully) addressed this with the new upgrade to the iPhoneOS (2.1), for both iPhone and iPod Touch.

However, prior to this, many people have lost the data associated with their apps because of this. I have had a couple inquiries regarding the syncing of mileage logs to the home computer when the device syncs via iTunes. Problem...Apple doesn't allow it!

It's true! Developers are not able to write applications that sync/save data during the iTunes sync process. This is why you'll see a number of applications that email reports (like MileBug), use file transfer apps, or even build custom web sites that allow the backing up of data.

So while this is not the most desirable setup, it's what Apple has given us to live with. We have looked at building a web application that would allow MileBug users to back up their data, but it just hasn't happened yet. So for now, please periodically email yourself a report of your data. Making backups is a good habit for any software you use. Enjoy!

However, prior to this, many people have lost the data associated with their apps because of this. I have had a couple inquiries regarding the syncing of mileage logs to the home computer when the device syncs via iTunes. Problem...Apple doesn't allow it!

It's true! Developers are not able to write applications that sync/save data during the iTunes sync process. This is why you'll see a number of applications that email reports (like MileBug), use file transfer apps, or even build custom web sites that allow the backing up of data.

So while this is not the most desirable setup, it's what Apple has given us to live with. We have looked at building a web application that would allow MileBug users to back up their data, but it just hasn't happened yet. So for now, please periodically email yourself a report of your data. Making backups is a good habit for any software you use. Enjoy!

Tuesday, September 9, 2008

How to Delete Individual Trips

Two people have asked how to delete individual trips, so I thought that would make a great choice for a new blog entry. Simply edit the trip you wish to delete and scroll to the bottom. There is a large, red, "Delete Trip" button at the bottom. Press that and another "Delete Trip"/"Cancel" screen appears for confirmation. Press "Delete Trip" to confirm and your trip is gone!

To delete ALL your trips, just press the garbage can icon at the top left of the Trips List. You will have to confirm it, but remember it cannot be undone! I recommend emailing yourself a report of all your data first, but this is a great way to start fresh each month, quarter, year, or whenever you want.

To delete ALL your trips, just press the garbage can icon at the top left of the Trips List. You will have to confirm it, but remember it cannot be undone! I recommend emailing yourself a report of all your data first, but this is a great way to start fresh each month, quarter, year, or whenever you want.

Thursday, September 4, 2008

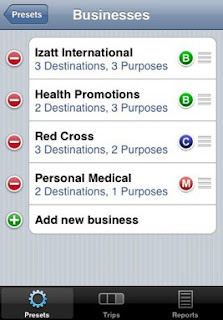

Reordering Presets: A hidden feature

A wonderful little feature in MileBug is the ability to reorder the presets. So if you change jobs, or start a new business, and want that one at the top...no problem!

A wonderful little feature in MileBug is the ability to reorder the presets. So if you change jobs, or start a new business, and want that one at the top...no problem!It all happens inside the Presets Manager (left button on the tab bar at the bottom). Just place your finger on the 3 horizontal lines to the far right of the business (or other preset) you want to move and drag it to the place you want it. Voila!

This is true for all the presets: Businesses (including Charities and Personal Medical), Destinations, Purposes, and Vehicles.

And, in case you didn't know, you can also delete presets, too. Just press the red circle to the left of the item you want to delete and a Delete button will appear. Press Delete, and it's gone! (Be aware: no undo!)

Labels:

business,

hidden feature,

mileage tracker,

presets,

reorder

Monday, September 1, 2008

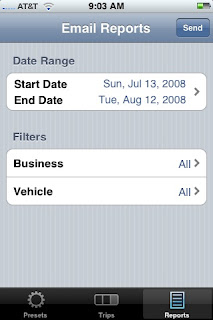

MileBug Reports: HOW and WHAT

There have been a couple of inquiries regarding the reports feature of MileBug, so I thought I would describe the HOW as well as provide an example of WHAT it produces. First, to access the reports, simply click the Reports tab at the bottom of the application. You will be brought to this screen.

Once here, you can select the date range you wish for the report. The default is the last 30 days. Then choose a single business or ALL businesses, and likewise a single vehicle or ALL vehicles. Click the Send button at the top right and your email program will open up.

You may choose to email the report to whomever you wish and with whatever subject you wish. You may also add text to the body of the message, but it is highly recommended you add only to the top of the message unless you're very comfortable with HTML.

Once the report arrives in your email Inbox, you can read the enclosed instructions for a nice styled report (via HTML) or an Excel report which allows you to manage the data how you wish. Basically, just select and copy all the text beginning with Tax Deductible Mileage Report and paste it into Word for a styled report, or paste it into Excel for a spreadsheet. For the best experience in Word, simply select File-->Page Setup and choose Landscape. Excel just requires some adjusting to the column and row size.

Here's a sample report pasted into Word, and the same report pasted into Excel.

There are two sections: Summary and Detail. Both are grouped by business and grouped by vehicle within business, to make it the easiest for filing tax forms for each business/charity. The last column is Type: B-Business, C-Charity, M-Medical.

Wednesday, August 27, 2008

iPhone GPS: Why NOT use it for mileage tracking?

When we first designed MileBug, our intent was to use the new GPS feature of the iPhone 3G to track mileage. It would require less effort and provide more accuracy in case of IRS audit. Unfortunately the iPhone will not allow 3rd party apps, like MileBug, to run in the background.

So while we thought it would be great for a user to simply turn on MileBug at the start of a trip and have the whole trip mapped, we realized that if the user chose to do anything else with their phone (take a call, use maps, pass to passenger to play a game, etc) then the pathway during that activity would be lost! Why? Because in order to answer/place a call, get directions, or play a game, the mileage app would be shutdown. We could always pick back up once the user restarted the app after the other activity, but where would that leave the user...with a gap in the trip! And what if they forgot to restart? It's fairly easy to go back and fill in odometer readings, but a little more challenging to go back and fill in GPS coordinates.

We also considered having a simple GPS start point and end point and let Google Maps calculate the route. That may still be an option, but it serves the IRS more than the user. That is, Google Maps will calculate the shortest route, and thus the smallest deduction. What if you got lost and spent another 5 miles wandering? Or if you were given different directions, other than the shortest route? The start/stop GPS points would cheat you out of the deduction you truly deserved.

Please let us know how you feel about using GPS. Did we place too much importance on the concerns we came up with? Would it still be useful in some way? Just click the "comments" link below and let us know. Thanks!

Monday, August 25, 2008

The Presets: Easy selection for easy trip recording

When we designed MileBug, we decided to go with the same idea as your car radio preset buttons. There's generally a lot of writing when miles are tracked in a notepad and we wanted to eliminate as much of that as possible. So we created the Presets. You can setup multiple businesses, multiple destinations and purposes per business, and even multiple vehicles. Each one is a simple selection when recording a trip.

We also didn't want the presets to be required. They are wonderfully useful for those who have a lot of details to keep track of. But we also wanted MileBug to be simple to use from the get go. So if you want to set up your businesses and common destinations up front, you can. If you want to dive in and use it, you can do that, too. New businesses can be added on the fly, as can destinations, purposes, and vehicles.

Under the Presets tab, you can manage your lists as well. They can be edited, reordered, added to, and removed. Businesses can be of 3 different types: Business, Charity, Medical. Each one has the corresponding IRS deduction rate associated with it. In an upcoming release, there will also be a "Personal" category for those wishing to track their personal miles. There will also be the option of setting your own custom rates per category.

We also didn't want the presets to be required. They are wonderfully useful for those who have a lot of details to keep track of. But we also wanted MileBug to be simple to use from the get go. So if you want to set up your businesses and common destinations up front, you can. If you want to dive in and use it, you can do that, too. New businesses can be added on the fly, as can destinations, purposes, and vehicles.

Under the Presets tab, you can manage your lists as well. They can be edited, reordered, added to, and removed. Businesses can be of 3 different types: Business, Charity, Medical. Each one has the corresponding IRS deduction rate associated with it. In an upcoming release, there will also be a "Personal" category for those wishing to track their personal miles. There will also be the option of setting your own custom rates per category.

Saturday, August 23, 2008

Welcome to the MileBug Blog!

We're really excited to be sharing MileBug with you now via the App Store! What a great way to expand the iPhone and the iPod Touch with so many quality apps (and some not so quality). And now we are a part of it!

Thank you all for your wonderful comments and we're providing this blog as a way for you to provide even more feedback so as we continue to improve and build on MileBug, we can do so with your interests in mind. This is also where you will learn about the little extras and what we have coming in the future.

So stay tuned and let's get our tax deductions!

Thank you all for your wonderful comments and we're providing this blog as a way for you to provide even more feedback so as we continue to improve and build on MileBug, we can do so with your interests in mind. This is also where you will learn about the little extras and what we have coming in the future.

So stay tuned and let's get our tax deductions!

Labels:

comments,

features,

mileage tracker,

milebug,

trip log

Subscribe to:

Comments (Atom)